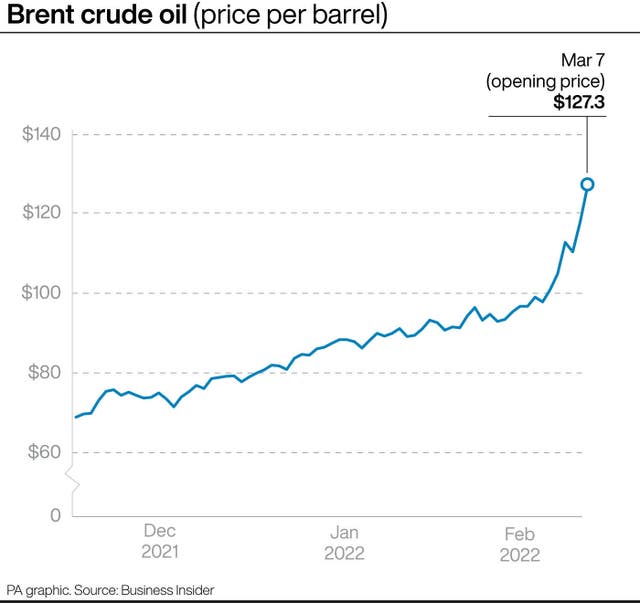

The price of oil has soared to its highest level in 14 years on Monday, a move that is likely to put a further squeeze on households, as the US and Europe discussed banning imports of Russian crude.

Briefly touching 139 dollars per barrel, Brent crude – which is the most commonly used way of measuring the UK’s oil price – was at its highest price since 2008.

It later settled back down around 10 dollars off that peak but still at 14-year highs.

Over the weekend, US secretary of state Antony Blinken said that Washington is in “very active discussions” with countries in Europe over banning imports of Russian oil.

The move could seriously damage the Russian economy and comes after Vladimir Putin decided to send his troops on a full-scale mission to invade Ukraine.

The war has led to hundreds of civilian casualties and brought nearly unequivocal condemnation from other European countries.

While Europe and the US have so far resisted a ban on Russian oil, the heavy sanctions they have put on the country mean that many companies are baulking at buying anything from Russia.

This has led to a widespread boycott but a total ban would dry up supplies further.

Although Europe relies a lot more on Russia for its natural gas, the country is still the biggest single exporter of oil to the EU.

According to data from Eurostat, around a quarter of the bloc’s oil imports and around 46% of its gas came from Russia in the first part of last year.

The UK is less reliant on Russia for both but prices here largely mirror those in Europe.

Sanctions have so far not hit these vital supplies which prop up the economies of both sides.

Natural gas is much less likely to get sanctioned as it would seriously hurt Europe to go cold turkey on Russian gas imports. Meanwhile Russia relies on these exports to fund large parts of its economy.

Despite that, leaders on the continent are seriously considering the prospect that the taps might be cut off, either by the Europeans or by the Russians.

“France’s finance minister (Bruno) Le Maire said the government is working on risk evaluation of cutting off Russian gas,” said Neil Wilson, chief market analyst for Markets.com.

He added: “It was only a matter of time before we got to the point of banning Russian oil and gas because of the escalation in the conflict and targeting of civilians. Or at least got to the point of talking about it.”

The panic was also obvious on stock markets on Monday morning as the FTSE 100, which had already lost heavy ground last week, dropped another 2.5% within half an hour of opening.

European and Asian markets were also down.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel